2020 might be described as both the worst of times and the best of times for trade finance. COVID-19 dealt an unprecedented blow to the global economy, with international trade and consequently trade finance bearing the brunt of the shock. However, with the pandemic making it difficult to go about our business in a traditional and established manner, we did see corporates rapidly speed up the digitalisation of trade finance.

During this difficult year the Bank for International Settlement Innovation Hub (BISIH) Hong Kong Centre and the Hong Kong Monetary Authority (HKMA) joint hands to launch the TechChallenge. This initiative was intended to showcase the potential for new technologies to resolve the pain points in trade finance, we named it TradeTech. It was supported by the Asian Development Bank (ADB), the International Chamber of Commerce (ICC), the International Institute of Finance (IIF), the People’s Bank of China (PBOC), and the Wolfsberg Group.

Prior to the launch of the TechChallenge, the HKMA conducted a survey, which over 120 banks responded to. More than 70% of the respondents agreed that global trade finance needs are not adequately addressed. This is consistent with the ADB findings that the global trade finance gap persistently remains at around US $1.5 trillion. The research also identified pain points (e.g., KYC/AML/CTF compliance complexity, credit risk assessments for SMEs) where technology can help. Against this backdrop, the TechChallenge participants were invited to propose tech solutions to three problem statements:

- Connecting digital islands and increasing network size and effects

- Trade finance inclusion for SMEs

- TradeTech for emerging markets

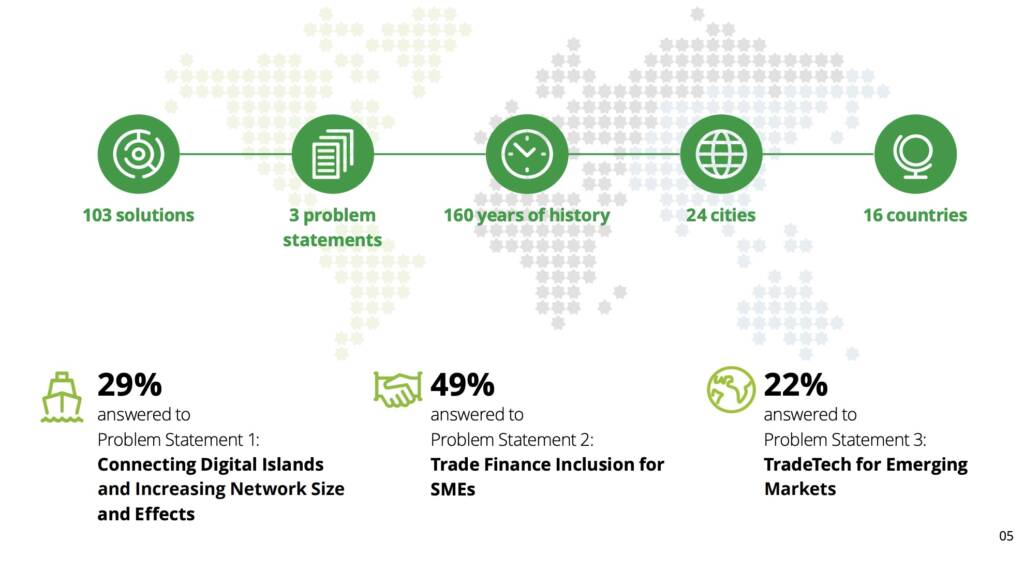

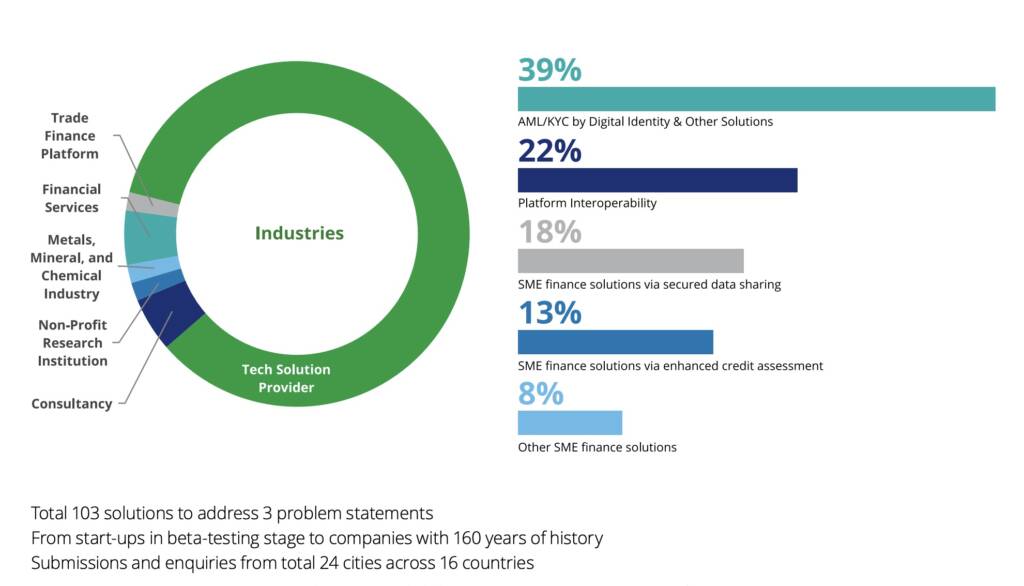

The response to the TechChallenge was impressive. We received a total of 103 solutions from 24 cities across 16 countries. These solutions came from a wide spectrum of participants, from start-ups in beta-testing stages to well-established companies with 160 years of history. In order to appraise these solutions, we invited a panel of judges who are trade finance experts from our partnering organisations, as well as leading practitioners and scholars in trade finance. Their judgment was based on six publicly announced criteria: (1) relevance, clarity, and depth (2) functionality and feasibility (3) market potential and viability (4) public good (5) impact and (6) innovation and creativity. The 17 awardees were announced in November, with their solutions showcased during the annual Hong Kong Fintech Week.

Essentially, the solutions proposed by the TechChallenge awardees can be grouped into two broad categories. The first category deals with pain points in specific segments of the trade finance process such as credit risk profiling, KYC/AML, and metadata. For example, Business Big Data and WeBank proposed using alternative data to assess credit risks of corporates. This data, such as logistics and related party data, are relevant indicators to the creditworthiness of corporates alongside more traditional financial statements. Furthermore, they run federated learning models to analyse distributed data. The beauty of these models is that data owners do not need to share their data with a third party, thereby allaying concerns about data confidentiality. In addition, Standard Chartered Bank and HKU-SCF Fintech Academy proposed a TradePro machine-learning model based on performance track records. As such, financing can be offered to smaller suppliers with low credit grades but high-performance track records.

Another pain point in trade finance is the costly process of onboarding for banks or other financial institutions, which discourage these institutions from extending credits to SMEs. In order to relieve this, a number of companies, such as KYC-Chain, EMALI.CO and Sedicci, proposed corporate digital identity solutions. These solutions could improve the efficiency of the KYC process by reducing paper-heavy operations and streamlining duplicated procedures. This would therefore enhance the corporate onboarding process. In regards to the related issue of metadata, essDOCs proposed a platform that would digitise and automate paper-heavy trade operations, financing, and logistics processes. Besides, HashKey Digital Asset Group proposed an open-source code toolkit to improve the usability of open data standards for digital trade documentation.

The second broad category of solutions take a macro view and deal with ecosystem connectivity instead of specific pain points within a single ecosystem. The central aim is to increase interoperability amongst trade finance platforms so that network size and effects can be maximised. In fact, the failure of many platforms to attract traffic flows and accomplish a critical mass of users is often attributable to incomplete digitalisation. Without end-to-end digitalisation, it is hard to incentivise companies to join the platform. To this effect, PwC proposed a solution to address the last mile connectivity gap between corporate ERP systems and other trade finance platforms.

Refinitiv, which since has become part of the London Stock Exchange Group, seeks to build an ecosystem that enables corporate receivables to become more liquid and funding to become more accessible for MSMEs across Asia. FreightAmigo proposes a one-stop supply chain finance platform that connects global shippers and logistics suppliers with financial institutions. The platform Velotrade seeks to match Asian exporters with institutional investors that have excess liquidity.

In summary, these solutions illustrate that tradetech has boundless potential to eliminate the inefficiencies prevalent in today’s trade finance sphere. The momentum of digitalising trade finance will definitely not stop with 2020 drawing to a close. Looking ahead, we believe the TechChallenge awardees will carry forward their creativity, aspirations, and efforts into 2021. Further development of their proposals and new prototypes are expected in the months ahead.

Read our latest issue of Trade Finance Talks, Spring 2021, here

Australia

Australia Hong Kong

Hong Kong Japan

Japan Singapore

Singapore United Arab Emirates

United Arab Emirates United States

United States France

France Germany

Germany Ireland

Ireland Netherlands

Netherlands United Kingdom

United Kingdom

Comments are closed.